Advisor-only planning software that helps you quickly identify IRMAA exposure, visually illustrate the real dollar impact year-by-year, and confidently guide higher-net-worth retirement planning conversations.

Built for financial advisors, insurance agents, and CPAs focused on IRMAA, Roth conversions, and retirement income planning.

IRMAA conversations often happen too late—after clients receive higher Medicare premiums and ask, "Why didn't we see this coming?"

Higher-net-worth clients don't understand why they're paying more for Medicare—until it's too late to plan around it.

Spreadsheets and manual calculations make it difficult to show clients the real impact of their income decisions on Medicare costs.

Without clear visuals, advisors miss chances to demonstrate their value through proactive IRMAA planning strategies.

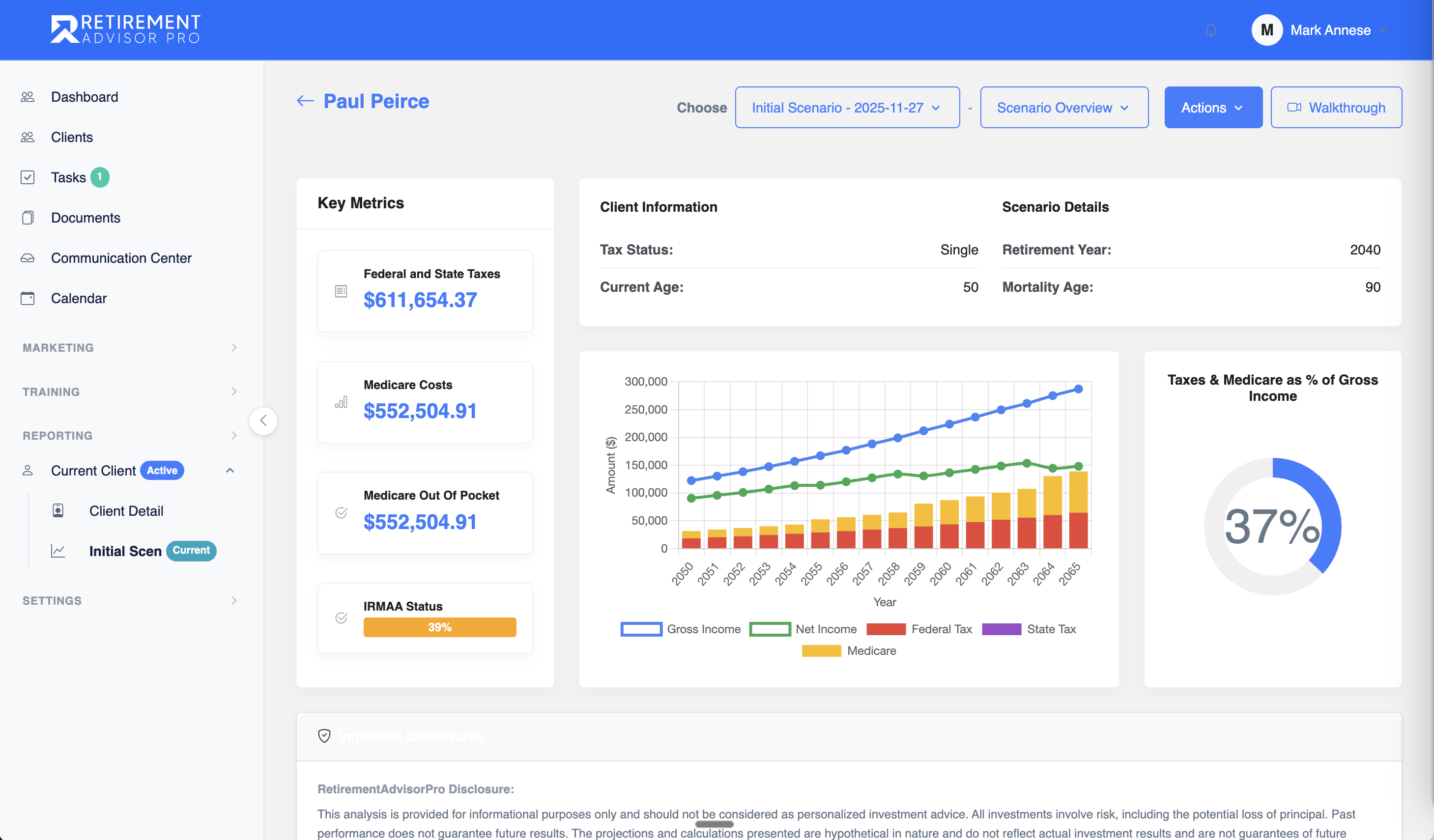

RetirementAdvisorPro helps advisors proactively identify IRMAA exposure and clearly illustrate how income decisions affect Medicare costs over time.

Walk clients through complex Medicare rules with confidence using clean, easy-to-understand visualizations.

Show the long-term impact of income choices, helping clients understand tradeoffs before costly surprises occur.

Connect IRMAA with Roth conversions and tax planning discussions in one unified view.

Watch a short advisor-only software demo to see how RetirementAdvisorPro supports clearer conversations, better planning decisions, and more confident client meetings.

Watch the Advisor DemoPosition yourself as a more strategic retirement advisor—without adding complexity to your workflow.

Watch the Advisor DemoAdvisor-only demo • No credit card required